Bradley County Arkansas Personal Property Tax . Online payments are available for. Search arkansas assessor and collector records online from the comfort of your home. Click next to pay your personal property and real estate taxes in bradley county, arkansas. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. To get started, please confirm the county you. Pay bradley county taxes online. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. You can use this website to pay your arkansas property taxes for select counties. This site was created to give taxpayers the opportunity to pay their taxes online. Taxpayers may enter in the parcel numbers they would.

from www.mapsales.com

Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. Taxpayers may enter in the parcel numbers they would. Click next to pay your personal property and real estate taxes in bradley county, arkansas. Pay bradley county taxes online. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. To get started, please confirm the county you. Search arkansas assessor and collector records online from the comfort of your home. This site was created to give taxpayers the opportunity to pay their taxes online. Online payments are available for. You can use this website to pay your arkansas property taxes for select counties.

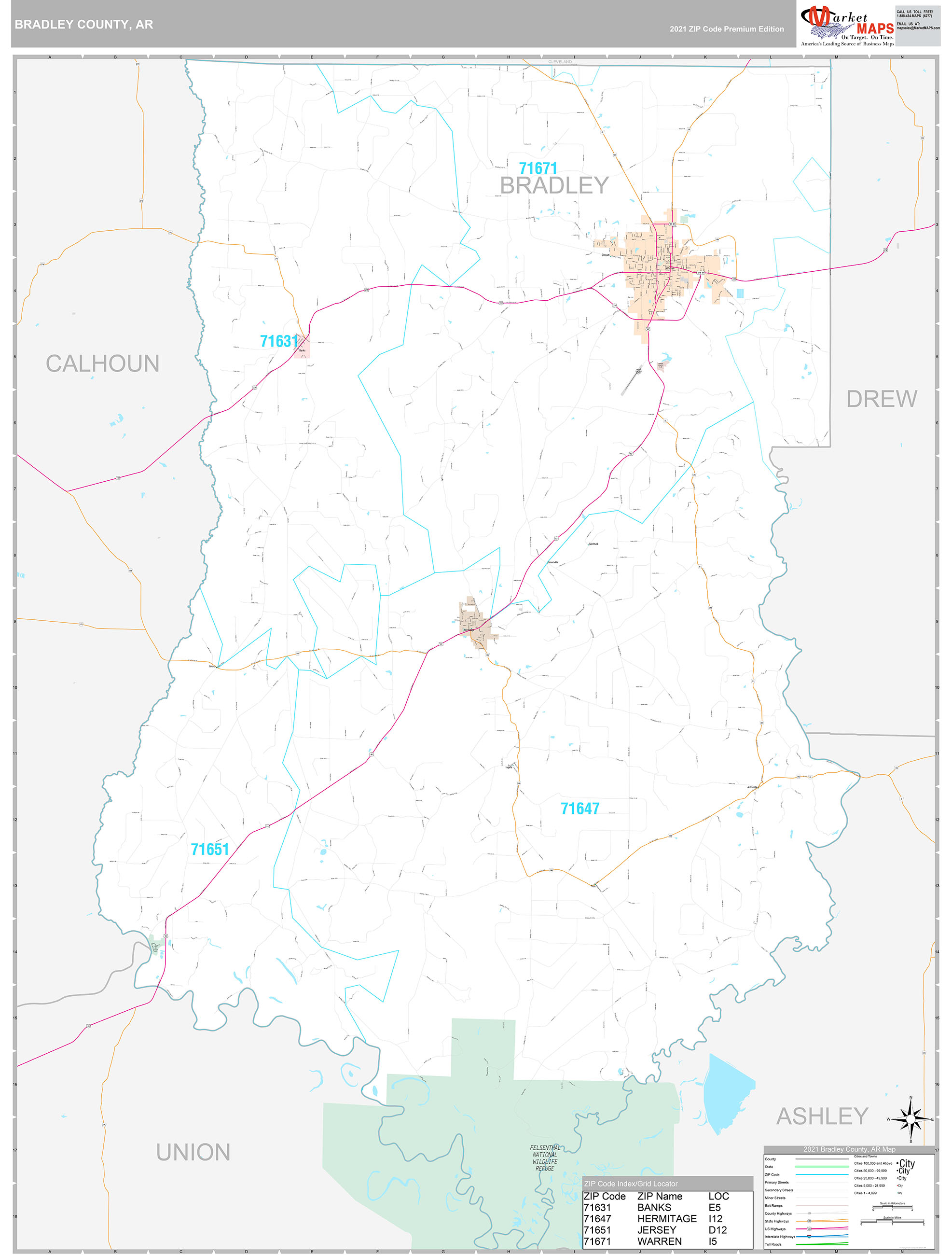

Bradley County, AR Wall Map Premium Style by MarketMAPS MapSales

Bradley County Arkansas Personal Property Tax Search arkansas assessor and collector records online from the comfort of your home. Taxpayers may enter in the parcel numbers they would. Pay bradley county taxes online. This site was created to give taxpayers the opportunity to pay their taxes online. You can use this website to pay your arkansas property taxes for select counties. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. To get started, please confirm the county you. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. Online payments are available for. Search arkansas assessor and collector records online from the comfort of your home. Click next to pay your personal property and real estate taxes in bradley county, arkansas.

From www.mapsales.com

Bradley County, AR Zip Code Wall Map Red Line Style by MarketMAPS Bradley County Arkansas Personal Property Tax Taxpayers may enter in the parcel numbers they would. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. To get started, please confirm the county you. Search arkansas assessor and collector records online from the comfort of your home. Taxable tangible personal property of new. Bradley County Arkansas Personal Property Tax.

From www.uaex.uada.edu

Bradley Programs Bradley County Arkansas Personal Property Tax Search arkansas assessor and collector records online from the comfort of your home. Click next to pay your personal property and real estate taxes in bradley county, arkansas. To get started, please confirm the county you. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. This site. Bradley County Arkansas Personal Property Tax.

From www.maphill.com

Satellite Map of Bradley County Bradley County Arkansas Personal Property Tax You can use this website to pay your arkansas property taxes for select counties. Taxpayers may enter in the parcel numbers they would. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. To get started, please confirm the county you. Click next to pay your personal property. Bradley County Arkansas Personal Property Tax.

From encyclopediaofarkansas.net

Bradley County Map Encyclopedia of Arkansas Bradley County Arkansas Personal Property Tax You can use this website to pay your arkansas property taxes for select counties. Online payments are available for. To get started, please confirm the county you. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. Click next to pay your personal property and real. Bradley County Arkansas Personal Property Tax.

From www.signnow.com

Tangible Personal Property Schedule Complete with ease airSlate SignNow Bradley County Arkansas Personal Property Tax Click next to pay your personal property and real estate taxes in bradley county, arkansas. Search arkansas assessor and collector records online from the comfort of your home. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. This site was created to give taxpayers the opportunity to. Bradley County Arkansas Personal Property Tax.

From www.landsofamerica.com

10 acres in Bradley County, Arkansas Bradley County Arkansas Personal Property Tax All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. You can use this website to pay your arkansas property taxes for select counties.. Bradley County Arkansas Personal Property Tax.

From www.mapsales.com

Bradley County, AR Wall Map Premium Style by MarketMAPS MapSales Bradley County Arkansas Personal Property Tax To get started, please confirm the county you. This site was created to give taxpayers the opportunity to pay their taxes online. You can use this website to pay your arkansas property taxes for select counties. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. Taxpayers may. Bradley County Arkansas Personal Property Tax.

From whereismap.net

Where is Bradley County Arkansas? What cities are in Bradley County Bradley County Arkansas Personal Property Tax Pay bradley county taxes online. Online payments are available for. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. To get started, please confirm the county you. Taxpayers may enter in the parcel numbers they would. You can use this website to pay your arkansas property taxes. Bradley County Arkansas Personal Property Tax.

From townmapsusa.com

Map of Bradley, Lafayette County, AR, Arkansas Bradley County Arkansas Personal Property Tax This site was created to give taxpayers the opportunity to pay their taxes online. Pay bradley county taxes online. Taxpayers may enter in the parcel numbers they would. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. Search arkansas assessor and collector records online. Bradley County Arkansas Personal Property Tax.

From diaocthongthai.com

Map of Bradley County, Arkansas Địa Ốc Thông Thái Bradley County Arkansas Personal Property Tax Pay bradley county taxes online. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. This electronic real estate and personal. Bradley County Arkansas Personal Property Tax.

From sdgaccountant.com

Personal Property Tax SDG Accountants Bradley County Arkansas Personal Property Tax Pay bradley county taxes online. Online payments are available for. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. All personal property. Bradley County Arkansas Personal Property Tax.

From www.land.com

19.82 acres in Bradley County, Arkansas Bradley County Arkansas Personal Property Tax Search arkansas assessor and collector records online from the comfort of your home. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired. Bradley County Arkansas Personal Property Tax.

From hd.housedivided.dickinson.edu

Bradley County, AR House Divided Bradley County Arkansas Personal Property Tax Online payments are available for. Search arkansas assessor and collector records online from the comfort of your home. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. This site was created to give taxpayers the opportunity to pay their taxes online. You can use this website to. Bradley County Arkansas Personal Property Tax.

From www.argenweb.net

Unknown Places in Bradley County, Arkansas Bradley County Arkansas Personal Property Tax This site was created to give taxpayers the opportunity to pay their taxes online. Click next to pay your personal property and real estate taxes in bradley county, arkansas. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. All personal property should be reported to the county. Bradley County Arkansas Personal Property Tax.

From www.land.com

42 acres in Bradley County, Arkansas Bradley County Arkansas Personal Property Tax Taxpayers may enter in the parcel numbers they would. This electronic real estate and personal property tax payment service is being offered to the citizens of bradley county as an additional. Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. All personal property should. Bradley County Arkansas Personal Property Tax.

From www.neilsberg.com

Bradley County, AR Median Household By Race 2023 Neilsberg Bradley County Arkansas Personal Property Tax Online payments are available for. Search arkansas assessor and collector records online from the comfort of your home. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. Pay bradley county taxes online. To get started, please confirm the county you. Click next to pay your. Bradley County Arkansas Personal Property Tax.

From www.dreamstime.com

Arkansas Bradley County Map Stock Vector Illustration of states Bradley County Arkansas Personal Property Tax This site was created to give taxpayers the opportunity to pay their taxes online. All personal property should be reported to the county assessor every year between january 1 and may 31 to avoid a late assessment penalty. To get started, please confirm the county you. Online payments are available for. Pay bradley county taxes online. Taxable tangible personal property. Bradley County Arkansas Personal Property Tax.

From www.youtube.com

Arkansas Property Taxes YouTube Bradley County Arkansas Personal Property Tax Taxable tangible personal property of new residents and new businesses established between january 1 and may 31, and taxable tangible personal property acquired by residents. Click next to pay your personal property and real estate taxes in bradley county, arkansas. Taxpayers may enter in the parcel numbers they would. Search arkansas assessor and collector records online from the comfort of. Bradley County Arkansas Personal Property Tax.